Customer Stories - National Australia Bank ECAL increases ‘on-time’ payments by up to 12%!

ChallengeNational Australia Bank wanted to test how ECAL payment reminders would compare to SMS reminders. |

SolutionECAL’s solution worked to increase ‘on-time’ payments by up to 12% over SMS, and provide a better user experience. |

1. Introduction

National Australia Bank, one of the ‘big four’ banks in Australia, engaged ECAL to test how payment reminders in the calendar stack up against SMS reminders.

Consumers find it very difficult to stay on top of their monthly credit card payments. They want an easy way to manage payments, and want to avoid ‘late fees’. Late payments also significantly affect your credit rating.

For banks, the cost of ‘bill chasing’ is a significant expense, so they want to avoid payments going into ‘collections’. More on-time payments means a reduction in costs associated with ‘collections’ activities and customer service call handling.

It also helps the drive to ‘paperless’ and keeps their customers happy – which is a vitally important success metric for banks.

2. Objectives

- Test customer interest in a calendar reminder feature

- Test effectiveness of calendar reminders against SMS reminders

- Increase on-time payments by min. 2% (compared with SMS reminders)

3. Strategy

The project would target a cohort of bank customers who were prone to payment default and prone to entering ‘collections’. For the sake of the test, customers would receive an SMS with a feature link to sync payment reminders to their mobile calendar.

NB: In a full integrated rollout, the feature is integrated into the mobile banking app, and online banking portal.

4. Solutions

Participating NAB customers received two entries in their calendar for their upcoming monthly credit card repayment:

- A ‘payment reminder’ event (2 days prior to due date), and

- A ‘payment due’ event (on the due date)

Both entries appeared at 12 noon, and had an alert at 5 minutes prior to prompt response. Event details were limited for the trial, with a link direct to nab.com.au to make payment.

The test project would focus on Apple users as a priority.

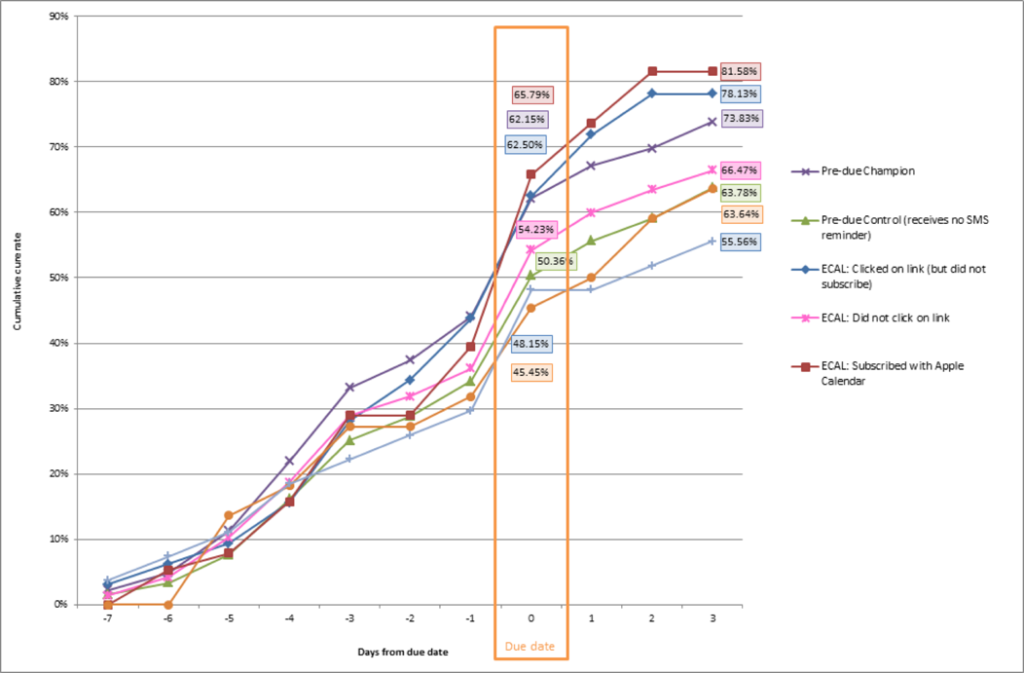

5. Outcomes

- The Participation Rate by banking customers in the project was 15%, extremely high and well above normal for bank project trials;

- Payments by ECAL (Apple) users were the best performing overall, delivering:

- 65.79% cure rate by the due date (+3.64% better than SMS reminders);

- 81.58% cure rate at 2 days after due date (+12%);

- The two-date ‘payment reminder’ entry for ECAL (Apple) users resulted in the biggest increase in payments (+37%);

- The top two performing reminder methods were ECAL influenced.

Testimonials

"We could not be happier with the ECAL product. ECAL makes it easy to implement and even easier for our fans to download our calendars where they want them most!”

Vice President of Digital Media @ Hornets Sports & Entertainment

"The ECAL platform ensures that fans can easily find out where to tune in and watch Formula E live in their territory, providing us with the ability to deliver targeted messages to users, based on location and behaviour. ECAL is our highest performing digital marketing channel, contributing approximately one-third of new user data acquired. The team at ECAL are a great bunch and I would have no hesitation in recommending them."

Senior Digital Project Manager @ Formula E

“We welcome around 750,000 visits to our Bins, waste and recycling section on our website annually. Implementing ECAL’s ‘Sync to Calendar’ service, has not only significantly reduced the average website visit, but residents can now receive dynamic bin collection reminders in-calendar. When collection days change, as do the entries and reminders in our users calendar. We are proud to be the first council in the UK to provide this innovative service for our residents and are thrilled to see this as just the start of a great journey and synergy with ECAL”.

Senior UI Designer

Fixture release day is a key moment in the Premier League’s calendar. It signals the start of our new season and provides an opportunity for us to onboard new fans. ECAL’s platform provides a powerful communication channel for us to deliver against our key objectives – driving tune-in and referrals for our clubs and broadcast licensees.”

Head of Digital Operations

“Fixture release day is a highly anticipated event in the EFL calendar. ECAL's excellent support, from technical to strategic, allowed us to focus on maximising reach and delivering a timely and engaged service to our fanbase.”

Senior Data, Research and Insight Manager